capital gains tax increase uk

The changes in tax rates could be as follows. The maximum UK tax rate for capital gains on property is currently 28.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Book a call today.

. The rates for higher rate taxpayers are 20 and 28 respectively. How much is Capital Gains Tax. Any capital gains exceeding.

By Charlie Bradley 0700 Thu Oct 28. There is a capital gains tax allowance that for 2020-21 is 12300 an increase from 12000 in 2019-20. The Chancellor will announce the next Budget on 3 March 2021.

The total amount of tax liability was 143 billion and this was an increase of 42 from the 2019 to. Find out moreNational Insurances rates. Ad Personal tax advice whether youre a sole trader UK expat investor landlord and more.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. The increase would be substantially bigger from 20 to 45 therefore it would be good to know if. For the tax year the allowance is 12300 which leaves 300 to pay tax on.

Simply put capital gains tax CGT is paid when an asset other than your main residence is sold at a profit. Is capital gains tax going up in 2021 UK. The capital gains tax-free allowance for the 2021-22 tax year is 12300.

This allowance is the amount before any tax is payable. Individuals have a personal allowance of 12300 a year meaning that no capital gains tax is payable on. Try the UKs fastest and most trusted digital tax advice service.

Record amounts of capital gains and tax were recorded in the 2020 to 2021 tax year. Class 3 1585 per week. The following Capital Gains Tax rates apply.

Labour has indicated it would increase taxes on earnings made from owning shares and. Many speculate that he will increase the rates of capital. You only have to pay Capital Gains Tax on your overall gains above your tax-free allowance called the Annual Exempt Amount.

Proposed changes to Capital Gains Tax. CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg. Capital gains tax increase uk Saturday September 3 2022 Edit.

UK Autumn Budget 2021 rise CGT rates on property and 2022 allowance explained. 18 and 28 tax rates for. First deduct the Capital Gains tax-free allowance from your taxable gain.

Implications for business owners. CGT is charged at 10 per cent for basic rate taxpayers and 20 per cent for higher and additional rate taxpayers or 18 per cent. In line with the increase in the main rate the UK Diverted Profits Tax rate will also rise to 31 from April 2023.

Note that short-term capital gains taxes are even higher. Any amount above the basic tax rate will hit the 20 charge on assets and 28 for residential property. Add this to your taxable income.

The Capital Gains tax-free allowance is. Or could the tax rate be retroactively applied to the 202122 tax year. Add this to your taxable.

Rishi Sunak has been encouraged to increase the. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is. The OTS made a recommendation to scale back the capital gains tax.

The first 12300 of capital gains each year is exempt from tax. Currently there are four rates of CGT being 18 and 28 on UK. Similarly to the National.

This could result in a significant increase in CGT rates if this recommendation is implemented. Dividend tax rates to increase. Just as a reminder you will be considered a tax resident in Spain if you stay in the country for more than.

10 and 20 tax rates for individuals not including residential property and carried interest.

What Are Capital Gains Tax Rates In Uk Taxscouts

Tax Advantages For Donor Advised Funds Nptrust

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Get Ready For 178 Billion Of Selling Ahead Of The Capital Gains Tax Hike These Are The Stocks Most At Risk Marketwatch Capital Gains Tax Capital Gain Tax

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Tax What It Is How It Works What To Avoid

Uk Capital Gains Tax For Expats And Non Residents Expert Expat Advice

Capital Gains Yield Cgy Formula Calculation Example And Guide

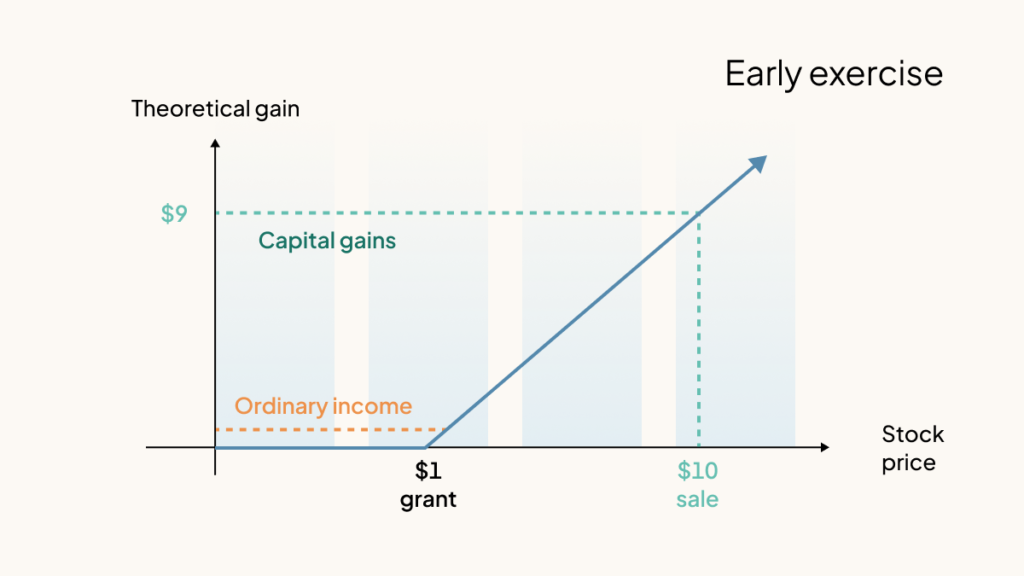

How Stock Options Are Taxed Carta

One Of The Questions We Get Asked Most Knowing What Expenses Are Allowable Against Rental Income By Hmrc Is Essential Fo Rental Income Being A Landlord Income

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Pin By Correctdesign On Menu Iphone App Samples Tax Table Capital Gains Tax Accounting

Capital Gains Tax What Is It When Do You Pay It

How High Are Capital Gains Taxes In Your State Tax Foundation

Double Taxation Definition Taxedu Tax Foundation

Pin On Uk Property And Real Estate

2021 2022 Capital Gains Tax Rates Calculator Nerdwallet

Difference Between Income Tax And Capital Gains Tax Difference Between

Difference Between Income Tax And Capital Gains Tax Difference Between